Retirement Savings Strategies for Self-Employed Professionals

Understanding retirement options when you're your own boss

View Infographic

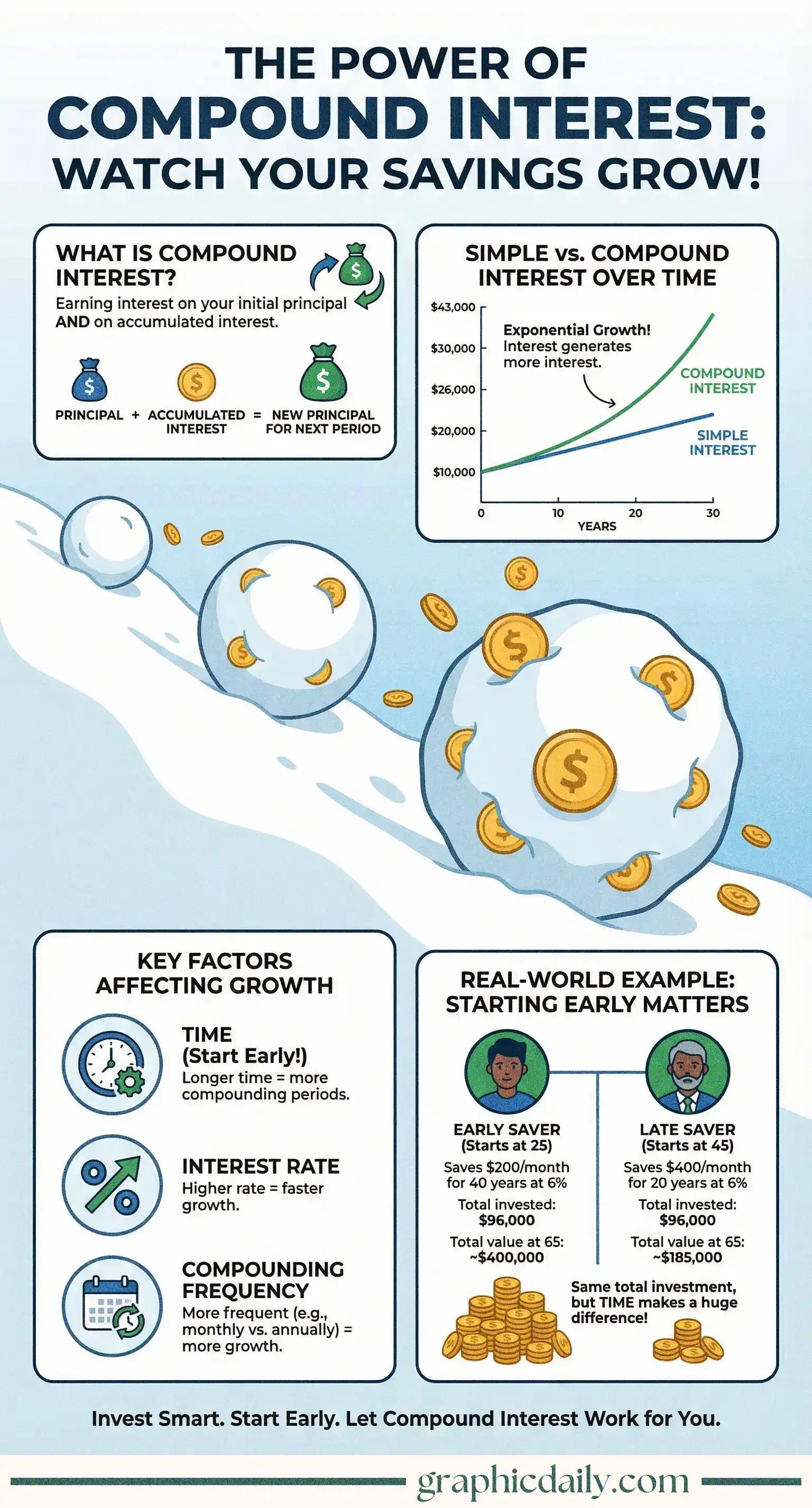

You know what genuinely fascinates me about compound interest? It's basically financial sorcery hiding in plain sight, and our infographic above breaks down exactly how this wealth-building phenomenon works in ways that finally clicked for me.

Here's the thing about compound interest that gets me every single time: your money doesn't just grow—it accelerates. According to Investor.gov, when you earn interest on both your original deposit and the interest you've already accumulated, you're essentially getting paid to let your money sit there and do its thing. Wild, right? The frequency matters too. Monthly compounding beats annual compounding because your earnings get reinvested more often, creating this perpetual growth engine that honestly feels almost too good to be true.

The infographic illustrates something that genuinely shocked me when I first researched this topic: starting just 20 years earlier can more than double your final savings, even if the total amount invested remains identical. That's not a typo! The difference isn't about contributing more—it's about giving compound interest more runway to work its magic, and I've seen this confirmed across multiple financial planning resources including NerdWallet's compound interest guide.

Small contributions today? They morph into substantial wealth tomorrow. Be patient, stay consistent, and watch the magic unfold.

Understanding retirement options when you're your own boss

View InfographicYour roadmap to financial wellness through smart monthly budgeting

View Infographic