Understanding Compound Interest and Growing Savings

How compound interest turns small savings into substantial wealth over time

View Infographic

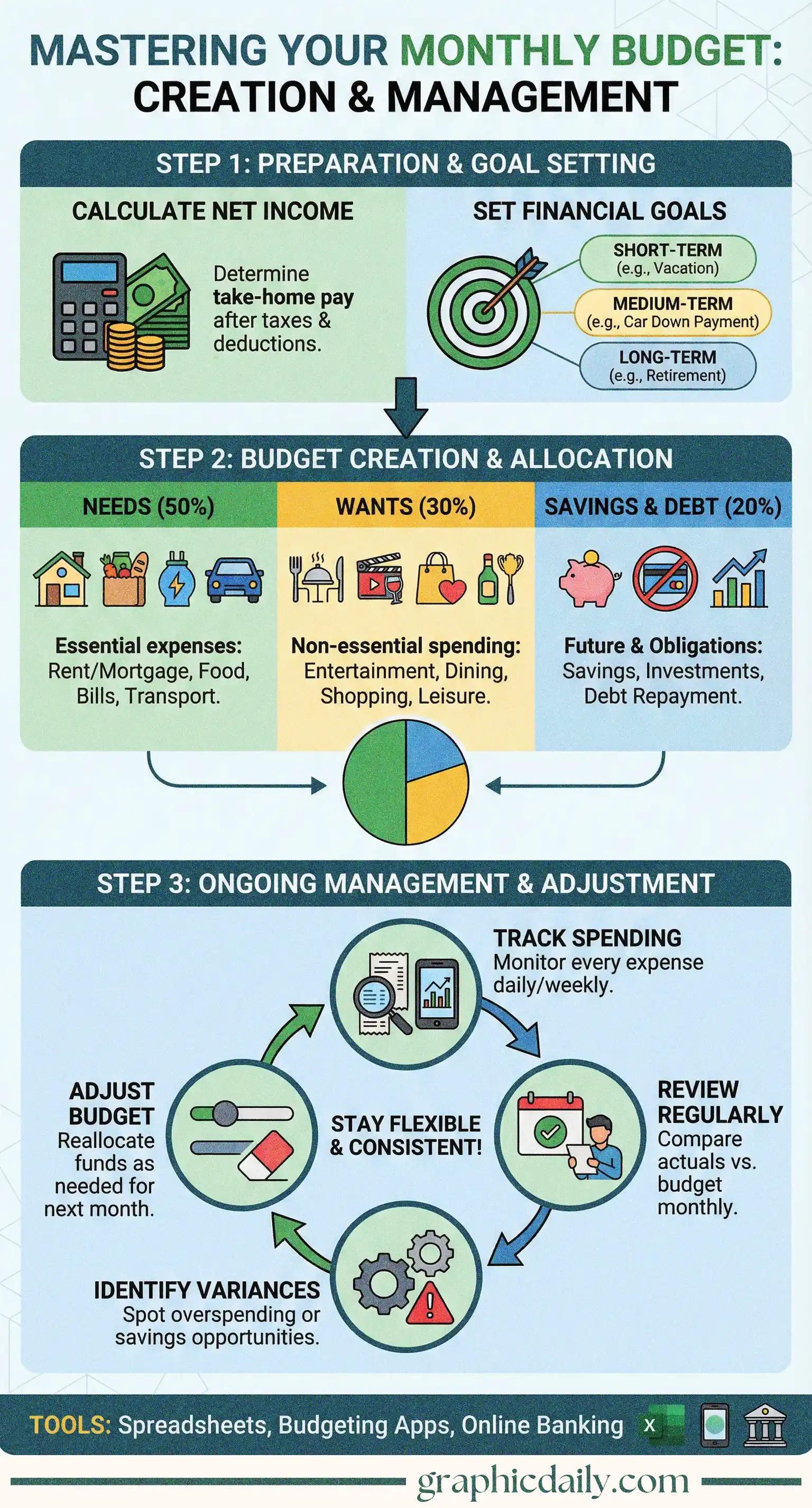

Ever stared at your bank account on the 25th of the month wondering where everything vanished? Yeah, me too. That's precisely why I dove into researching monthly budgeting, and honestly, the infographic above breaks it down way better than most finance textbooks I've encountered.

Here's the thing about budgets: they're not financial handcuffs. They're more like a GPS for your money, showing you exactly where it's meandering off to each month. Start by calculating your actual net income—that's the money hitting your account after taxes devour their share. Then comes the pivotal part: setting goals. Short-term, medium-term, long-term. Without them? Your budget lacks purpose.

I stumbled upon this allocation method from NerdWallet and it's refreshingly straightforward:

The wants category is where most of us hemorrhage cash without realizing it. Shocking but true.

A budget isn't some rigid spreadsheet you create once and abandon. Track every expense using apps or simple banking tools, then review monthly to spot those sneaky variances. Did takeout expenses spiral out of control? Adjust next month accordingly. According to Mint's budgeting resources, consistency matters far more than perfection—and honestly, that's liberating to hear.

How compound interest turns small savings into substantial wealth over time

View InfographicUnderstanding retirement options when you're your own boss

View Infographic