Understanding Compound Interest and Growing Savings

How compound interest turns small savings into substantial wealth over time

View Infographic

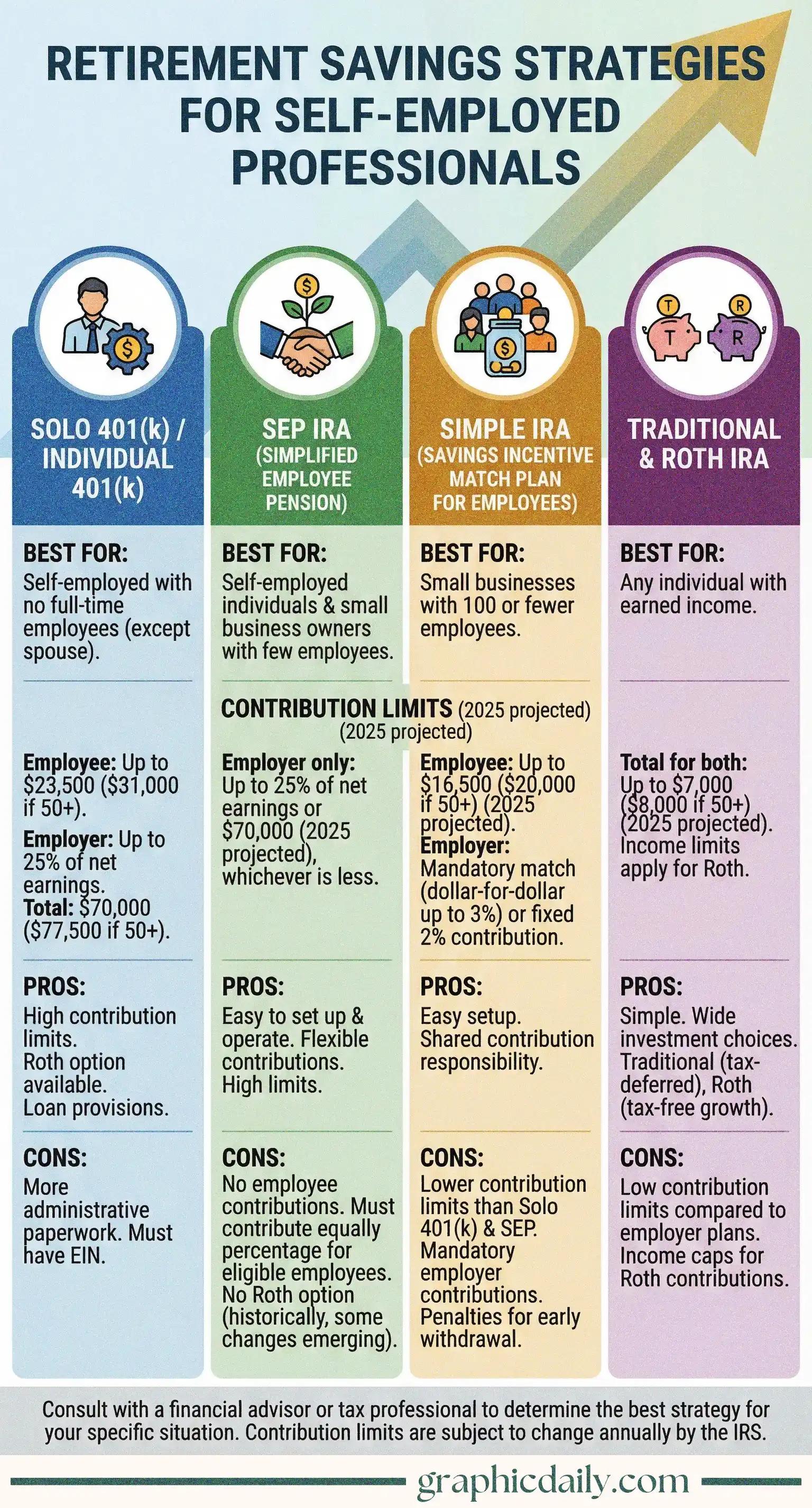

Being self-employed comes with incredible freedom, but retirement planning? That's where things get murky. I've been digging into this lately, and honestly, the options are more diverse than I initially thought—which is both encouraging and slightly overwhelming.

Our infographic above breaks down the main contenders for self-employed retirement savings, and each one has its own personality. The Solo 401(k) is basically the overachiever of the bunch, offering sky-high contribution limits (we're talking up to $66,000 for 2023 according to the IRS) if you're flying solo or working exclusively with your spouse. Then there's the SEP IRA, which shines for small business owners who need something straightforward yet powerful—though you'll need to contribute the same percentage for all eligible employees, which can get pricey.

The SIMPLE IRA works brilliantly for businesses with up to 100 employees, splitting the contribution load between you and your team. And don't sleep on Traditional and Roth IRAs! Sure, their limits are lower ($6,500 for 2023, or $7,500 if you're 50+), but they're ridiculously easy to establish and can complement your other retirement vehicles.

Here's the thing: there's no one-size-fits-all solution. Your business structure, income fluctuations, and long-term vision all matter tremendously. I'd recommend chatting with a financial advisor who understands the self-employed landscape—because getting this right now means actual freedom later. 🎯

Sources:

How compound interest turns small savings into substantial wealth over time

View InfographicYour roadmap to financial wellness through smart monthly budgeting

View Infographic