Understanding Compound Interest and Growing Savings

How compound interest turns small savings into substantial wealth over time

View Infographic

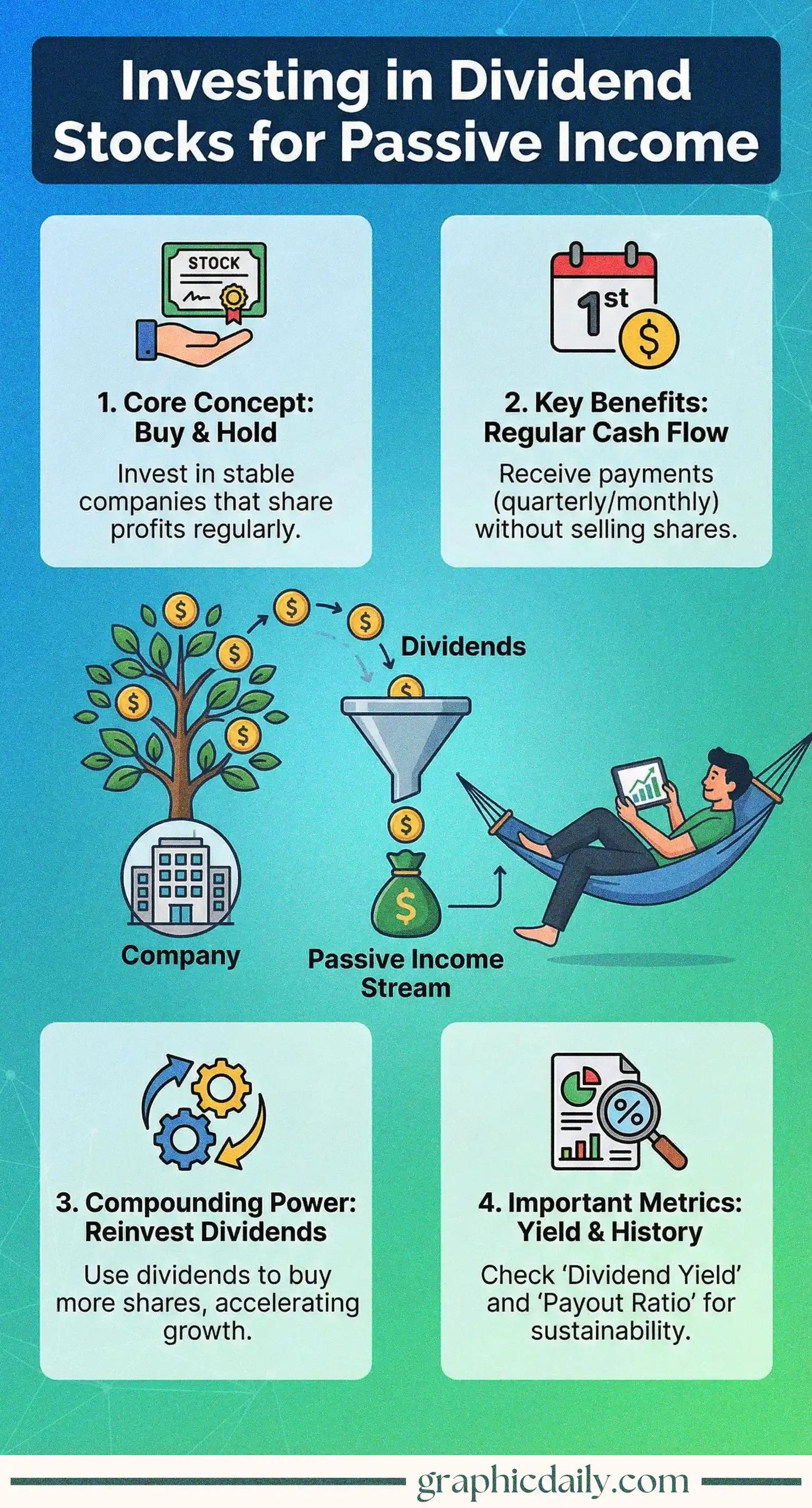

Ever thought about making money while you're literally doing nothing? That's the allure of dividend stocks, and honestly, the concept is simpler than you'd think.

The infographic above breaks down the essentials beautifully. At its core, you're buying shares in profitable, established companies—becoming a legitimate part-owner. These aren't risky startups. We're talking about corporations with track records that span decades, the kind that consistently generate profits and reward their shareholders with regular cash payments, usually every three months or so.

Here's where things get fascinating. Most people pocket their dividend checks and call it a day, but the truly transformative strategy involves reinvesting those earnings back into more shares. I spent some time digging into this approach, and the compounding effect is genuinely remarkable—your dividends generate more dividends, which then generate even more dividends. It's like a financial snowball rolling downhill, picking up momentum with each rotation.

According to Hartford Funds, reinvested dividends have historically contributed to a substantial portion of total stock market returns. That's not trivial!

Before diving in, you'll want to scrutinize two pivotal metrics: dividend yield (your annual return from dividends at current prices) and payout ratio (the percentage of earnings being distributed). The SEC's investor resources offer helpful guidance on evaluating these figures. A suspiciously high yield? Might signal trouble ahead. Balance is crucial here.

How compound interest turns small savings into substantial wealth over time

View InfographicUnderstanding retirement options when you're your own boss

View Infographic