Understanding Compound Interest and Growing Savings

How compound interest turns small savings into substantial wealth over time

View Infographic

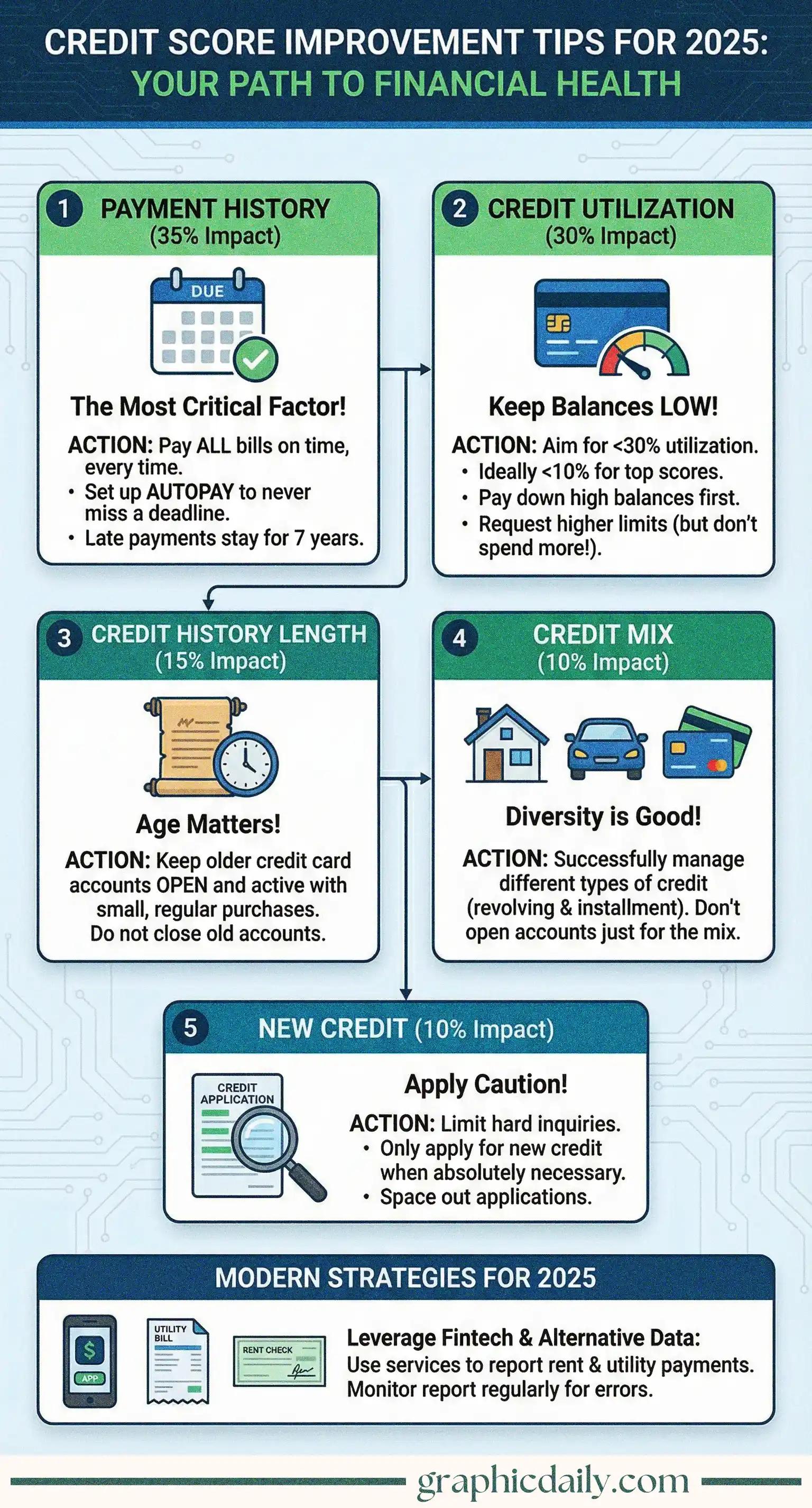

Look, I'll be honest—credit scores used to intimidate me until I actually dug into how they work. Turns out, it's less mysterious than we think.

Here's what really matters: your payment history carries the most weight, period. According to myFICO, this single factor accounts for about 35% of your score. Miss a payment? That sting lasts years. The infographic above breaks this down visually, and honestly, seeing those percentages made it click for me. Setting up autopay isn't glamorous, but it's arguably the most pivotal move you can make in 2025.

Credit utilization sounds fancy, but it simply means how much of your available credit you're actually using. Keep it under 30%, though sub-10% is where the magic happens. I was shocked to learn from Experian that maxing out cards tanks your score even if you pay them off monthly. Who knew? 💳

Something relatively new caught my attention while researching this—services like rent reporting can now boost thin credit files. Experian Boost and similar platforms let you add utility and telecom payments to your credit history, which feels like a genuine innovation for folks starting out or rebuilding.

Don't forget to grab your free annual reports from AnnualCreditReport.com. Errors happen more often than you'd expect.

How compound interest turns small savings into substantial wealth over time

View InfographicUnderstanding retirement options when you're your own boss

View Infographic