Writing a Business Plan That Attracts Investors

Essential components for crafting investor-ready business plans

View Infographic

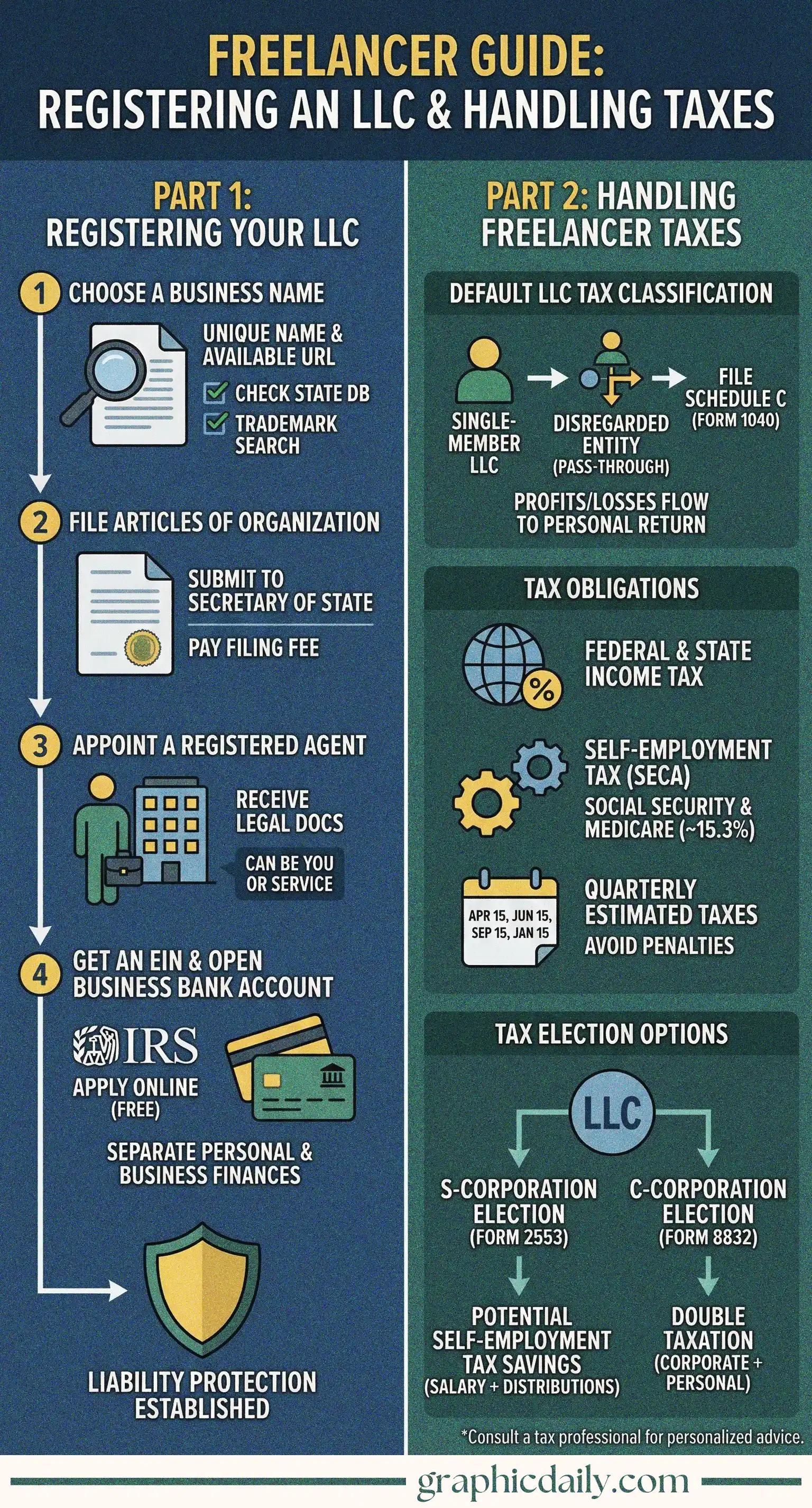

Running a freelance business? The freedom is intoxicating! But let's talk about the less glamorous stuff—like LLCs and taxes. Our infographic above distills this maze of information into something actually digestible, which honestly felt like a relief when I was researching all this.

Here's the deal: forming an LLC creates a shield between your personal finances and your business liabilities. If someone sues your business or you rack up debts, your personal savings and home typically stay protected—that "corporate veil" everyone mentions isn't just legal jargon, it's genuinely pivotal. The steps? Choose a unique business name, file Articles of Organization with your state, designate a registered agent (someone who receives official documents), and snag an EIN from the IRS website. Then open a dedicated business bank account. Never, ever mix personal and business funds.

By default, your single-member LLC gets treated as a "disregarded entity"—meaning the IRS ignores it exists and you report everything on Schedule C of your personal return. You'll face income tax plus the dreaded 15.3% self-employment tax covering Social Security and Medicare, according to IRS guidelines. Don't forget quarterly estimated payments!

Want to potentially reduce those self-employment taxes? Consider electing S-Corporation status by filing Form 2553, which lets you split income into salary and distributions (only the salary gets hit with SECA tax). C-Corp election exists too, but double taxation makes it less appealing for most freelancers.

Bottom line: Consult a real tax professional before making moves—this stuff gets intricate fast, and personalized guidance beats generic advice every time. The SBA and SCORE offer free resources worth exploring too! 📊

Essential components for crafting investor-ready business plans

View InfographicTurning jewelry-making into a profitable online venture

View Infographic