Writing a Business Plan That Attracts Investors

Essential components for crafting investor-ready business plans

View Infographic

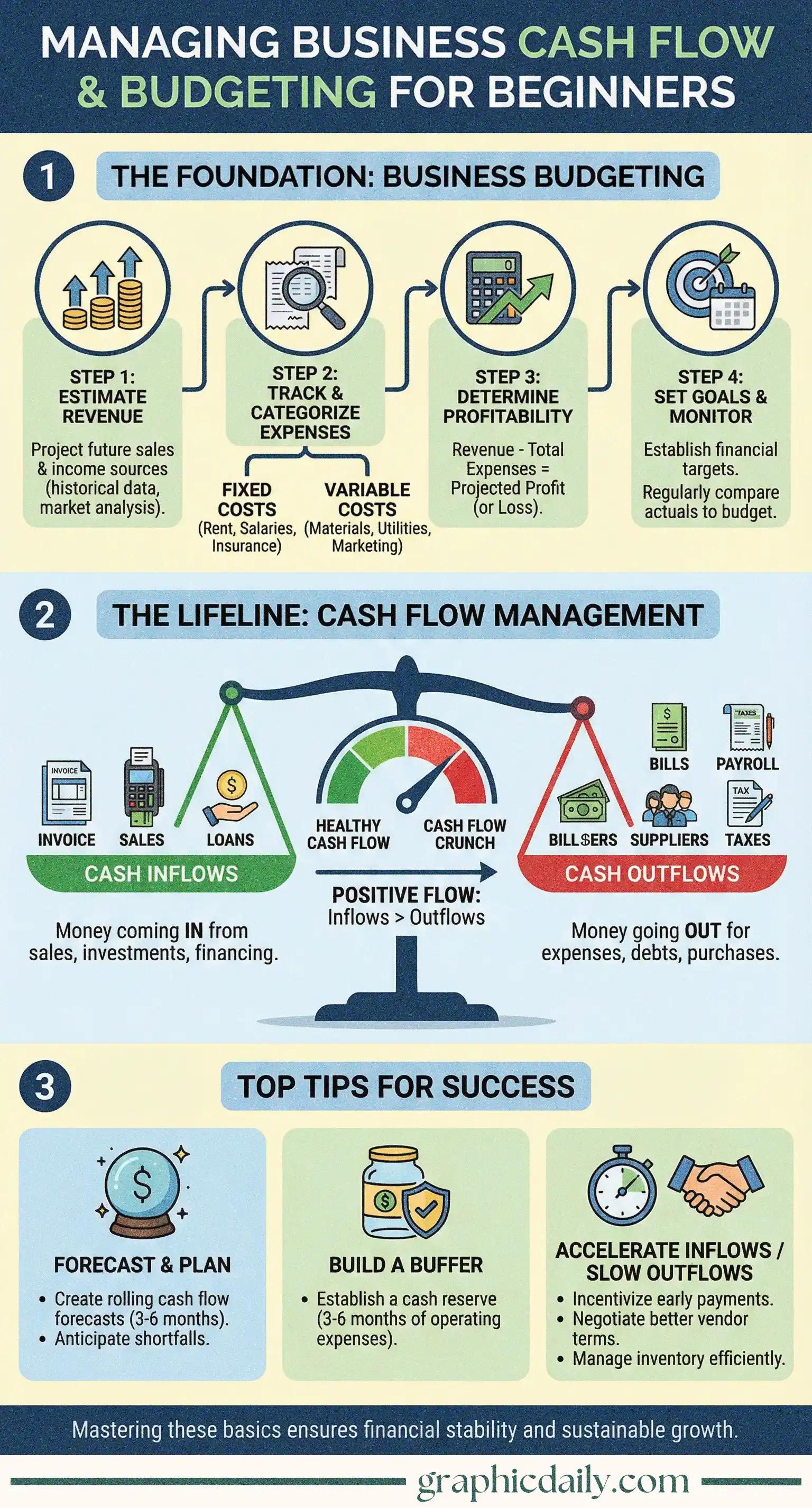

Look, I'll be honest—when I first started digging into business finances, the distinction between budgeting and cash flow felt unnecessarily complicated. But here's the thing: they're both absolutely vital, just in different ways, and our infographic above breaks down exactly why that matters.

Think of a budget as your business's GPS. It maps out where money flows from and where it should land over a given timeframe. According to research from the U.S. Small Business Administration, proper budgeting remains one of the pivotal factors separating thriving businesses from struggling ones. You'll estimate revenue based on past performance or market trends, categorize those pesky fixed expenses (rent never goes away, does it?) versus variable costs, then determine if you're actually making money. The real magic happens when you monitor regularly. Numbers don't lie.

Here's where things get interesting: profit isn't cash. 💰 I learned this the hard way while researching cash flow mechanics—you can look profitable on spreadsheets yet still struggle to cover payroll because your clients haven't paid their invoices. Cash flow tracks the actual movement of money, that tangible liquidity you need to keep doors open, and maintaining positive inflows versus outflows becomes your business's literal lifeline during lean periods or unexpected emergencies.

Want to stay afloat? Build that 3-6 month cash buffer, accelerate payments from customers, and negotiate smarter terms with vendors. Small adjustments compound surprisingly fast.

Sources:

Essential components for crafting investor-ready business plans

View InfographicTurning jewelry-making into a profitable online venture

View Infographic